Outlook on AUD/CAD

Short answer – Looking to go long in this market due to test of support on the monthly chart (top right). Shifting down into the weekly chart (top right), we see a descending channel where after a number of tests to the support line, we see a temporary break followed by a pull back above the support as conformed on the daily (bottom left). In order to pull the trigger, I would consider a break above the 200ma which is also a resistance area on the hourly chart (bottom right).

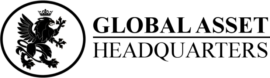

Outlook on EUR/USD

Short answer – looking to short. Monthly chart (chart 1) indicates that the trend is still flowing down while zooming into the weekly (chart 2), we see a potential head and shoulders pattern forming (however this is not formed until the break of te trendline which the 200ma indicates also). The daily chart (chart 3) shows a pullback into a potential resistance line before heading back down south and the hourly (chart 4) shows a resistance line confirmed by the 200ma and oversold condition in the RSI indicator.

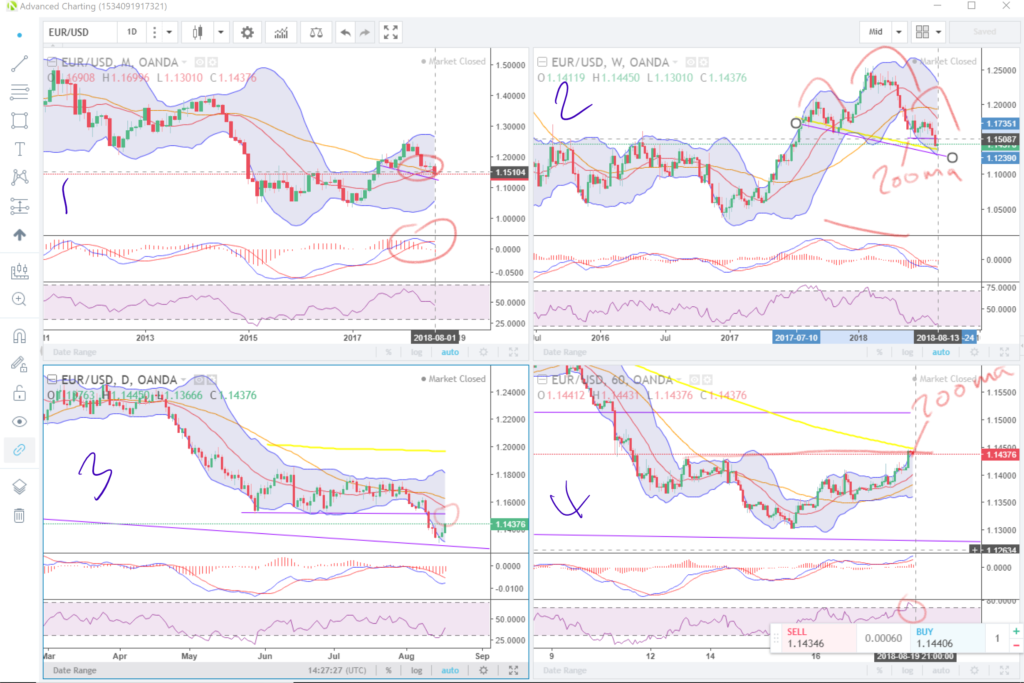

Outlook on USD/CHF

My short answer – Target sell. a resistance to break above the recent weekly highs could trigger a sell off towards recent or early 2018 lows. However as the current price is around a major number, I would expect a pop up past the 1.0000 and then a retracement down as shown in the hourly chart (bottom right).

Outlook on USD/JPY

My short answer – Look to sell. Monthly chart shows a falling trendline that appears to be obeyed by the price (top left) weekly shows a resistance at higher levels retreating from the 200ma (top right). On the daily chart we see that the second circle was a a failed attempt at around the 50% retrace and then a steady decline under the 20ma and the 50ma. On the hourly chart, I’d like to see a much stronger downward move to prove that the bears are really in control.

You must be logged in to post a comment.