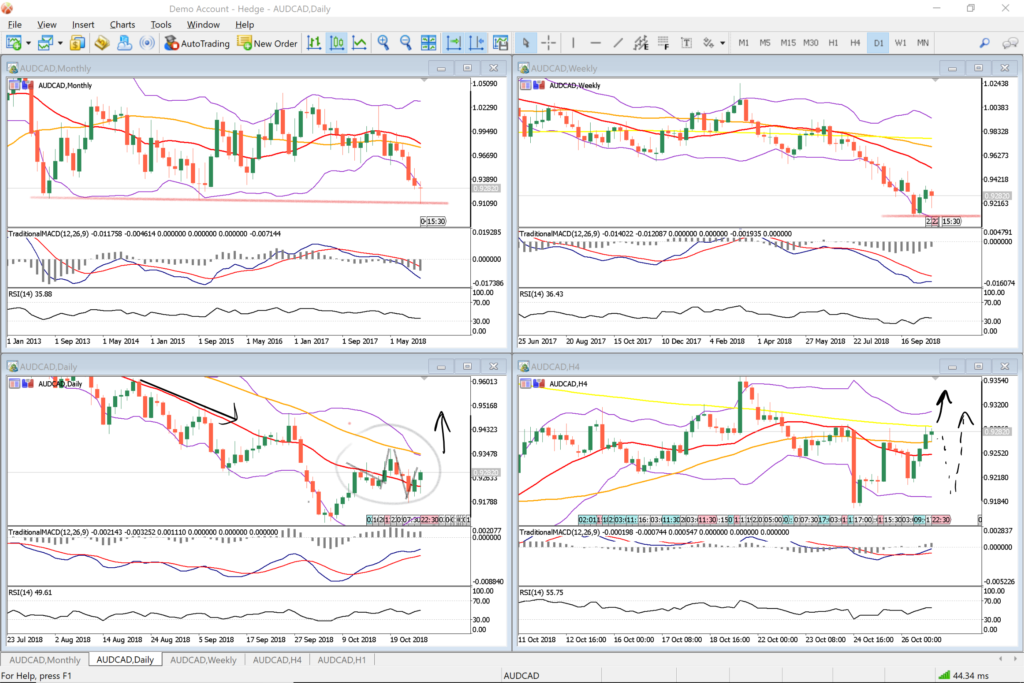

All weekly analysis are high-level and sets the week ahead. However markets change due to news and events so this may evolve. I do Monthly, weekly and daily scans every week for context. Higher TF help to guide the lower so as to give an indication or hint as to the direction of the market and potential entry points. I try to focus on price action and use indicators for probability of reversals or change in market sentiment.

Top Left=M1

Top Right=W1

Bottom Left =D1

Bottom Right =H4

20 SMA = RED

50 SMA = ORANGE

200 SMA = YELLOW

USDCHF – Sell

The monthly TF shows a slight pull back from the resistance area which can be seen in detail on the weekly chart. Price confirms it four times and the last being a doji. Although not necessarily meaning that it will reverse, however based on previous, may be worth watching this pair for confirmation before pulling the trigger. The daily chart shows that there has been some struggle for the bulls on the first arrow with the 3 – 4 doji, however pushed higher where the bulls faced further trouble. At the circle we see a small body candle followed by a bearish candle which could signify bears getting ready for action – Also see that it has pierced the top band of the bb indicator, RSI near 70% and MACD line approaching the signal line as well as the histogram hinting at a potential trend reversal as it nears the 0. I would wait for a break below the drawn line in the H4 chart as part of the confirmation for a short sell.

NZDUSD – Sell

Looking at the last few months on the monthly chart, we see doji followed by a fall in price repeated a few times. I’m not confident that we’ve reached the decline yet, and I’ve drawn the areas of potential monthly support. On the weekly however, theres a declining price channel where i expect price to continue to respect it. The daily chart shows this in more detail, and I’m unsure yet why theres a hammer at the end of the last week, however I expect that price should return downward once we see confirmation

GBPUSD – Sell

With the cable pair we see the last couple of bars reacting to the 20MA same as the weekly chart after some doji signifying some trouble around that price area before the drop last week. Looking on the daily chart, also the last candlestick looks like a hammer, I would like to see more of a lower shadow for me to think about a bullish move. The h$ chart might give some clue as to what might happen as you we can see a descending channel where there is a series of doji before a decline – this happens 3-4 times.. I expect the same to occur (decline), however confirmation of this would be needed before jumping in to the downside.

AUDCAD – Buy

With the AUDCAD, we see that the monthly chart shows price at a previously confirmed support area along with being at the bottom band of the Bollinger indicator. The weekly chart confirms with bullish candles where the last candle show rejection of lower price symbolised by the log shadow. On the daily, we see that price has been reacting to the 20MA with a false breakout and then what looks to me like a close above the 20MA which should mean that the 20MA as resistance, should now be support. In terms of trigger, I would wait for a pull back away from the 200MA on the H4 TF and more importantly a break of the 200 MA.

You must be logged in to post a comment.