All weekly analysis are high-level and sets the week ahead. However markets change due to news and events so this may evolve. I do Monthly, weekly and daily scans every week for context. Higher TF help to guide the lower so as to give an indication or hint as to the direction of the market and potential entry points.

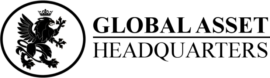

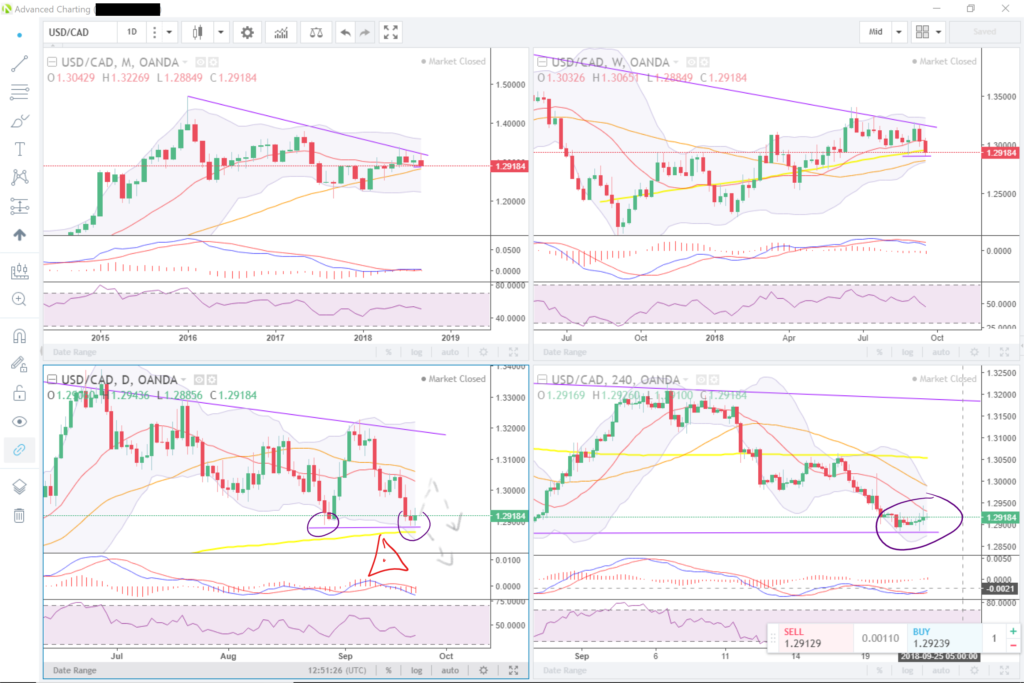

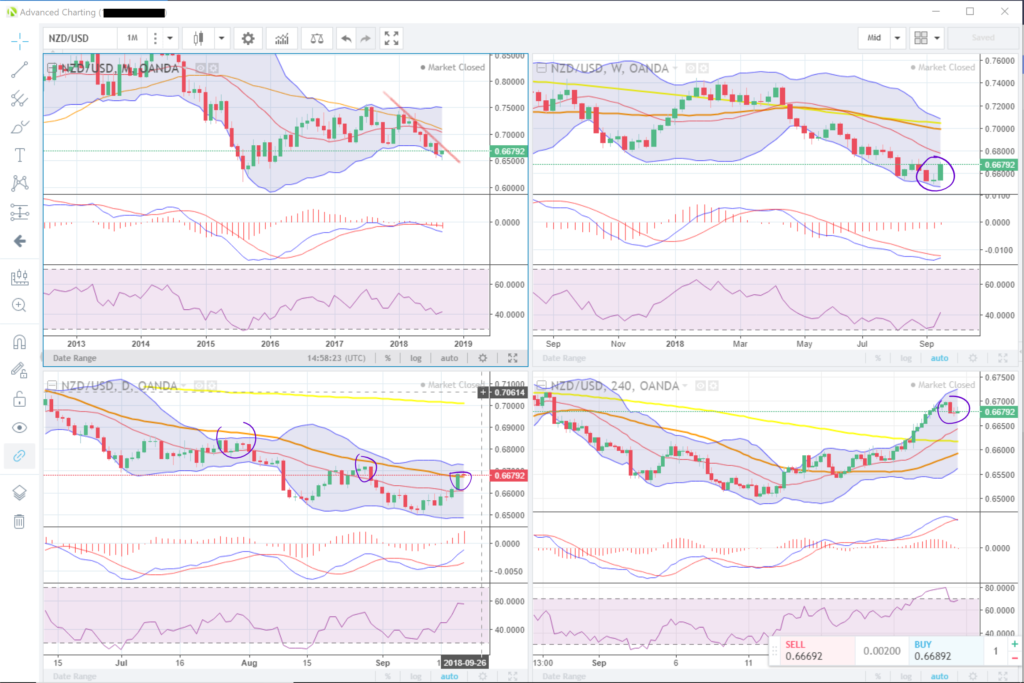

- Top Left=M1

- Top Right=W1

- Bottom Left =D1

- Bottom Right =H4

USDCAD – Sell

Bearish with the USDCAD pair based on the monthly and weekly trends. Dropping down into the lower TFs I see that there is potential support marked, however there is reason to be cautious – as this could be a temporary bounce upward (pullback) or a continuation to the downside. Looking at the H4 TF, there’s some consolidation taking place which I would look at before making an entry.

NZDUSD – Sell

The monthly chart doesn’t show any signs of obvious support/resistance and appears to be obeying the steep downward trend. The weekly shows a morning star candle pattern, however it looks as though it is at or near a previous resistance at the previous week high before the pattern formation. Weekly TF shows us a resistance at around the 50MA the end of the H4 session ends with what look like the beginnings of a downward move, however I would wait for more confirmation.

AUDUSD – Sell

Similar to the NZDUSD pair, I anticipate a downward move, however caution to be taken when looking at entries. Monthly shows a clear decline, the weekly shows us the morning star candle pattern however is very close to resistance at the previous doji patterns. If this pair were to close above the this, then the second set of major resistance would be around the 0.78 area shown by the upper resistance level on the daily chart. However, I would be looking at bearish signals of entry at the 0.739 area if the H4 chart moves up past session highs.

AUDCAD – Buy

Unlike the prior mentioned pair, based on the charts, I would be biased to the upside as longer term as we appear to be at the monthly support which will be confirmed if the last week of the month holds above the line. Similar to the AUDUSD and the NZDUSD there is a morning start pattern on the weekly however no obvious resistance levels based on the weekly chart. There is however a shorter TF resistance on the D1 where price is currently in contact. If price breaks above the descending trend line I would consider using it as a new support level.

EURUSD – Buy

The EURUSD I am more biased to the upside as we see in the monthly the current formation appears to be i) two dojis ii) a hammer iii) bullish MA crossover. However, looking at the D1 we see a pullback which could be preparation before a move to the upside or price could return to the zone that has been held for the last couple of months. The H4 looks like a potential entry as it has broken resistance however if I was conservative I would wait until a close above the 1.18 area.

You must be logged in to post a comment.