USDCHF – Sell

Continuing with the bearish sentiment that I reported for last week, I believe there is still a bear market although on the weekly chart (2) the two doji should cause us to be cautious around that area. N the daily chart (3) we see that there is a pull back, however I estimate that this will likely return back to a downward move.

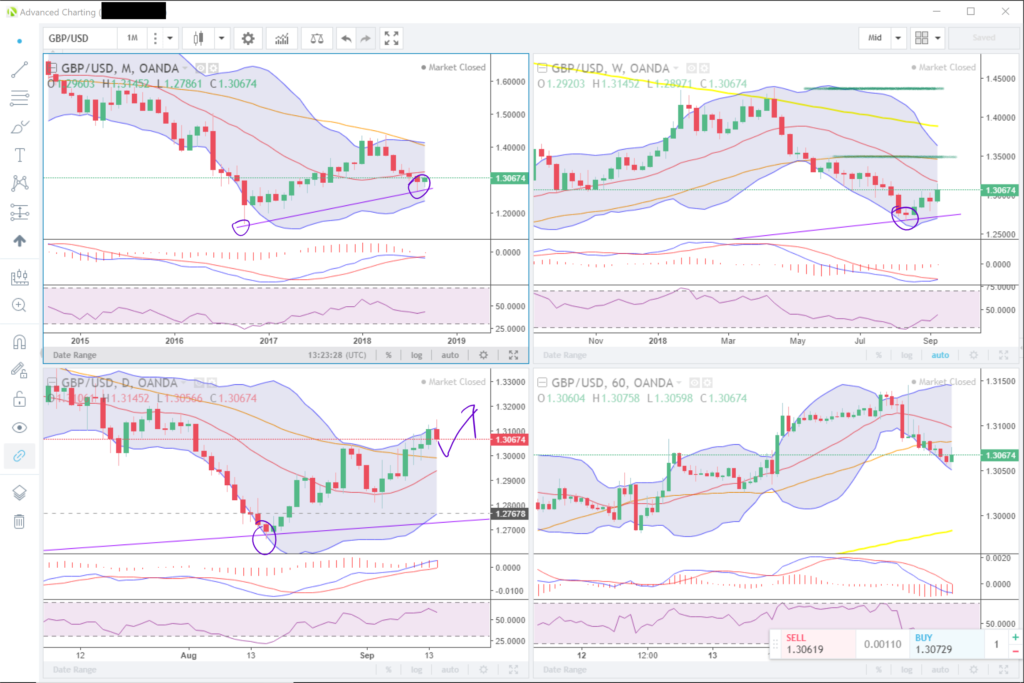

GBPUSD – Buy

Longer term I estimate a bullish sentiment in this market when viewing the monthly (1) and weekly (2)charts. The daily (30 chart shows that there is a bearish candlestick at the top of the range which also converges with the top of the BB area. I then expect a shorter term descent before a return to the upside.

EURUSD – Buy

My view on the EURUSD is that it could be heading into bullish territory as we see by the hammer on the monthly chart (1). Notice that this seem to happen around a convergence of moving averages (20 and 50). Following on in the weekly chart, we see he 200 MA being tested a number of times, the last being around August. Looking at the daily chart (3), we see the strong resistance line which is tested a number of times, Additionally we can see over the last few days that the prise has been trailing the 20MA and may look to finally break resistance to become support, or potentially continue downward towards the lows.

EURJPY – Sell

The falling descending trend line appears to be obeyed by the price as can be seen on the weekly chart (2). Looking at the daily chart (3), we can see a bearish candle pattern formed at the conjunction with the horizontal resistance which also has been tested a number of times. Additionally we’re at the top of the Bollinger band along with negative RSI divergence.

You must be logged in to post a comment.