All weekly analysis are high-level and sets the week ahead. However markets change due to news and events so this may evolve. I do Monthly, weekly and daily scans every week for context. Higher TF help to guide the lower so as to give an indication or hint as to the direction of the market and potential entry points. I try to focus on price action and use indicators secondarily for probability of reversals or change in market sentiment.

Charts shown do not necessarily mean that I will be entering them, however I will observe for potential opportunities as they’re either a setup being played or about to be played. All thoughts welcome for purpose of self improvement!

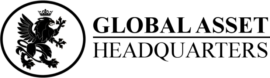

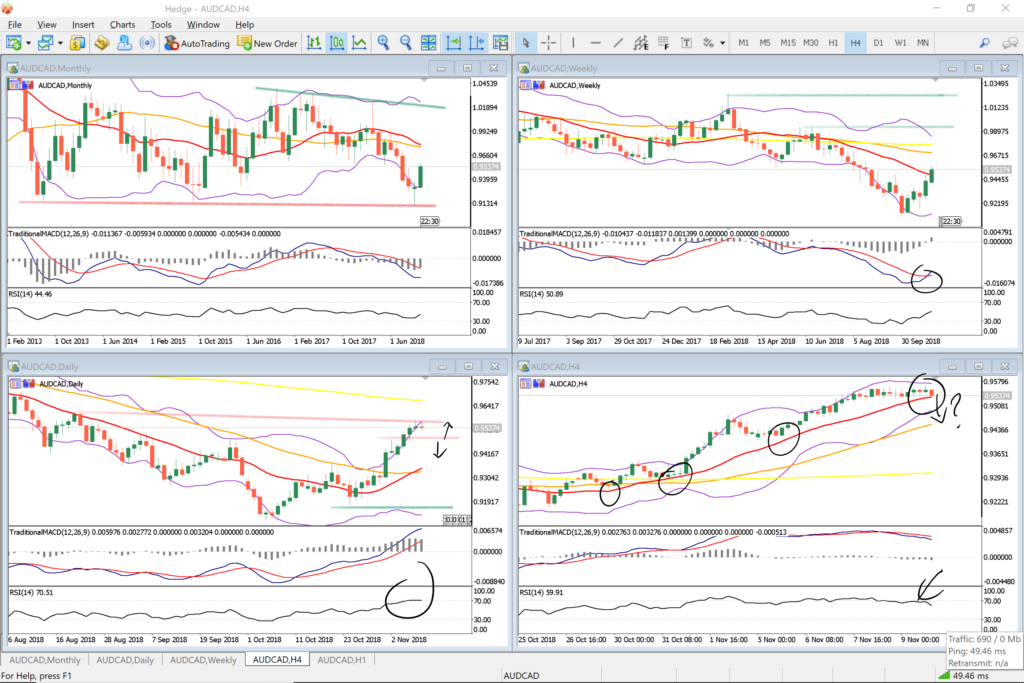

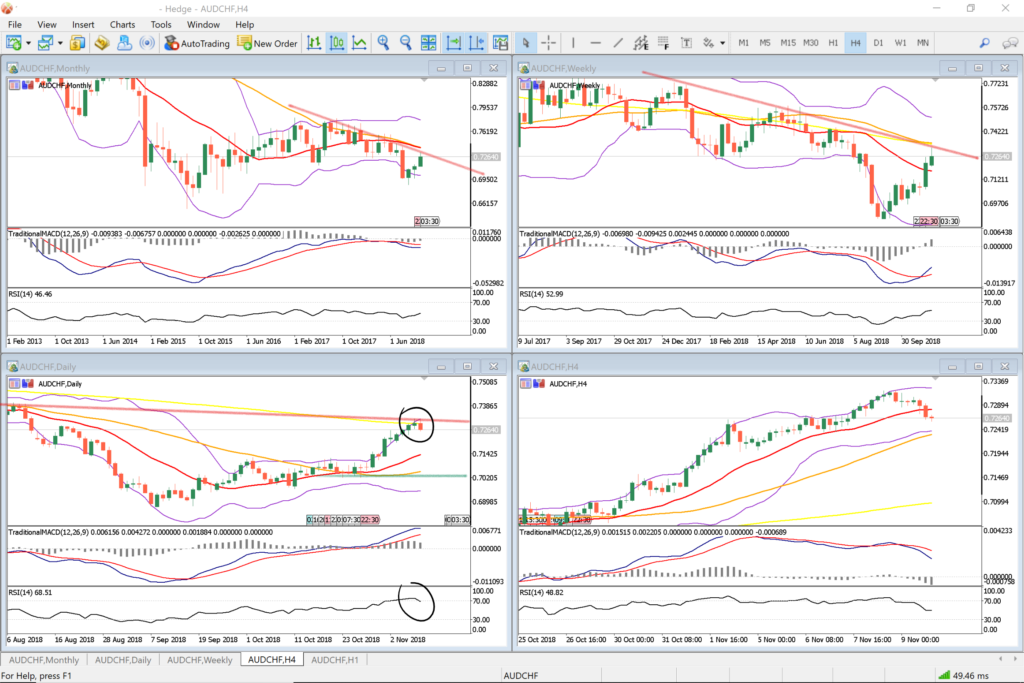

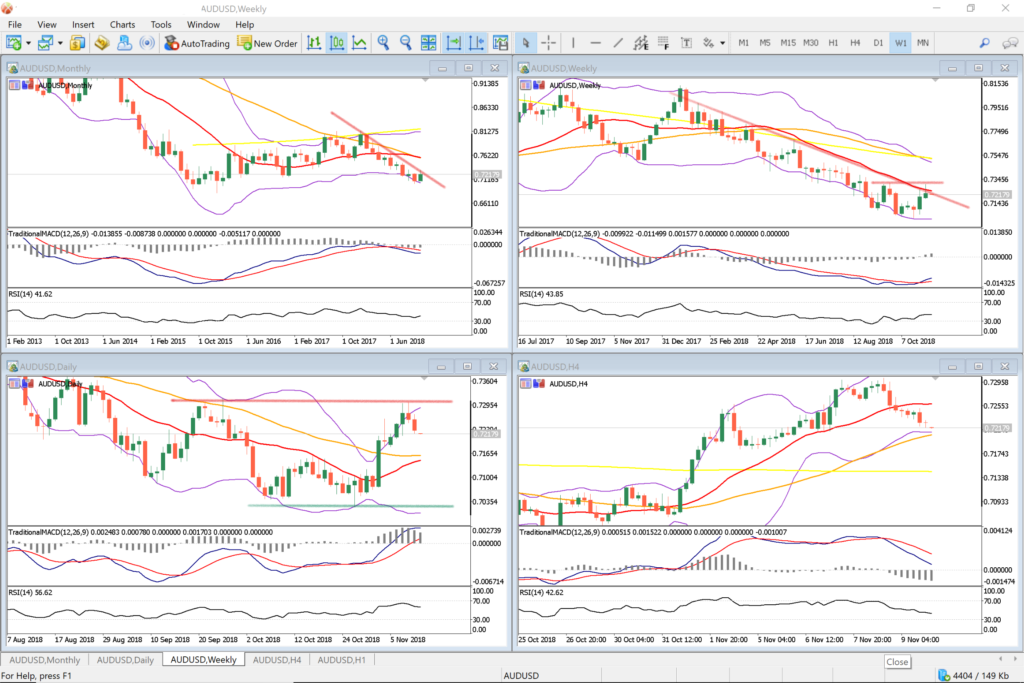

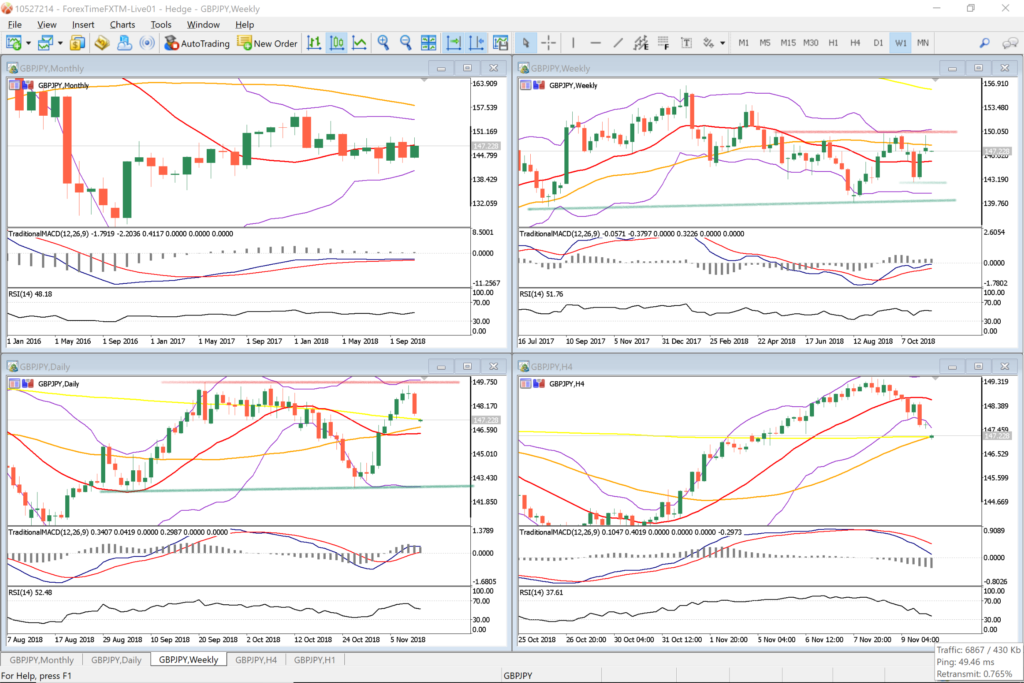

Top Left=M1

Top Right=W1

Bottom Left =D1

Bottom Right =H4

20 SMA = RED

50 SMA = ORANGE

200 SMA = YELLOW

Bollinger Bands = PURPLE

MACD (prefer to use in non trending market)

RSI (prefer to use in non trending market)

AUDCAD

- Still bullish long term (M1, W1)

- Short term bearish (D1)

- Two doji as resistance indicating market tired (D1)

- Oversold on RSI (D1)

- Expecting bounce around previous resistance area (D1)

- If this is broken, potential continuation down (D1)

- Price reacting to the 20MA (H4)

- Await break below 20MA to sell (H4)

- Await move above highs to buy (H4)

AUDCHF Sell

- Trendline being respected (M1, W1)

- 200 and 50 MA tested (W1)

- Doji and bearish engulfing pattern (D1)

- Price rejection at red trend line and 200 MA (D1)

- Overbought in RSI (D1)

- Target at green line (D1)

- 20MA broken on (H4)

AUDJPY – Buy

- Expecting pullback to broken upper channel (old resistance, new support)

- Watch for behaviour around 200MA and top of channel as may be false breakout back into channel? (D1)

- Indecision over last few months with this market (M1)

- Descending channel broken at the top but price rejection as 50MA (W1)

- Price broken out of descending channel and above 200MA (D1)

- Touched overbought area in RSI (D1)

- Look to initiate buys at new support see H4 for potential entries, or sell if break back into channel (W1,D1)

AUDUSD – Sell

- Descending trendline being respected (M1, W1)

- Horizontal support being respected (W1, D1)

- Target at green line (D1)

- Likely pullback to 20MA (H4)

- Look for sell on bearish candles at the 20MA (H4)

CHFJPY – Buy

- Ascending trendline respected (M1, W1, D1)

- Target at green line (W1, D1)

- Price pulled back to Fib 61.8 level which is surpassed last week (W1)

- Price reacting to 20 and 200 MA (D1)

- Higher Lows on last couple of sessions (H4)

GBPJPY – Sell

- Resistance at red line (W1)

- Bearish engulfing pattern at resistance (D1)

- Two doji confirming resistance along with 200MA (W1)

- I expect pullback before further descent

- Target at green line (W1, D1)

You must be logged in to post a comment.