All weekly Forex analysis are high-level and sets the week ahead. However markets change due to news and events so this may evolve. I do Monthly, weekly and daily scans every week for context. Higher TF help to guide the lower so as to give an indication or hint as to the direction of the market and potential entry points. I try to focus on price action and use indicators secondarily for probability of reversals or change in market sentiment.

Charts shown do not necessarily mean that I will be entering them, however I will observe for potential opportunities as they’re either a setup being played or about to be played.

Disclaimer: This is not financial advice but for educational purposes ONLY

My Approach:

First I look at my dashboard of the market to see any patterns of strength or correlation between pairs. Once I see a pair of interest, I look at it starting from Monthly to get sense of long term direction, then I move down timeframes towards M15. If I am interested in placing a trade, I open a M5 chart.

Chart Setup

21 SMA = RED

55 SMA = ORANGE

144 SMA = GOLD

Bollinger Bands = PURPLE

MACD 21/55 (prefer to use in non-trending market)

RSI (prefer to use in non-trending market)

News

At the moment I stay out of market at these times however, I keep aware of what is going on. Times are in GMT (0)

|

Mon Sep 30 |

1:00 |

NZD |

ANZ Business Confidence |

|

|

9:30 |

GBP |

Current Account |

|

|

22:00 |

NZD |

NZIER Business Confidence |

|

Tue Oct 1 |

2:30 |

AUD |

Building Approvals m/m |

|

|

5:30 |

AUD |

Cash Rate |

|

|

|

AUD |

RBA Rate Statement |

|

|

10:20 |

AUD |

RBA Gov Lowe Speaks |

|

|

13:30 |

CAD |

GDP m/m |

|

|

15:00 |

USD |

ISM Manufacturing PMI |

|

Wed Oct 2 |

13:15 |

USD |

ADP Non-Farm Employment Change |

|

|

15:30 |

USD |

Crude Oil Inventories |

|

Thu Oct 3 |

15:00 |

USD |

ISM Non-Manufacturing PMI |

|

Fri Oct 4 |

2:30 |

AUD |

Retail Sales m/m |

|

|

13:30 |

CAD |

Trade Balance |

|

|

|

USD |

Average Hourly Earnings m/m |

|

|

|

USD |

Non-Farm Employment Change |

|

|

|

USD |

Unemployment Rate |

|

|

19:00 |

USD |

Fed Chair Powell Speaks |

AUDCAD – Bullish

W1: Price below moving averages in down trending order (21 < 55 < 144) which is bearish

W1: Positive divergence with price and RSI

D1: Price making higher lows

D1: Price responding to ascending trend line as support

D1: Price at 23.6% Fibonacci level which may be used as a support level

D1: Two doji, signifying indecision at current price levels.

D1: 21 and 55MAs beginning to converge

H4: Price consolidating between monthly and weekly pivot areas

H4: higher lows on ascending trend line with month pivot point as resistance (rising wedge)

H4: Positive divergence between price and MACD histogram

H1: 21 MA has crossed over the 55 MA

H1: Bollinger Band has begun hugging the price zone, which can signify that some volatility may enter the market shortly

If the above holds true and there are bullish around 5/15min, look to place long orders based on Price Action, MA Cross, Indicator Action or combination.

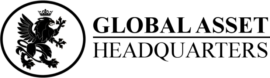

AUDCHF – Bullish

W1: High time frame story is that price had broken support to the down side held since AUG 2015 and returned above. Rejected by 21 MA and now looking to attack the support area again. However, price has been as a stand-off ending in a doji pattern at the support area. My bias is that price will move upward

W1: Price below moving averages in down trending order (21 < 55 < 144) which is bearish

W1: Positive divergence with price and RSI

D1: series of doji candles the whole of last week

D1: Mid-week doji pierced monthly pivot point which acted as support

D1: Mid-week doji pierced 38.2% Fibonacci area which acted as support

D1: Price seems to be edging higher as though in rounded bottom fashion

H4: Price formed piercing line patter at Weekly S2 pivot as support

H4: Price consolidating between Monthly pivot, Weekly Support and daily 38.2% fib level – This area is significant

H4: Bollinger Band has begun hugging the price zone, which can signify that some volatility may enter the market shortly

H4: MACD has crossed the signal line to the upside

H1: Bullish candle reversal pattern at support area

H1: MACD/sig lines is rising while price action in horizontal zone

H1: Mas has started to converge and appear as a resistance area, I expected price to reject downward before a push to the upside

If the above holds true and there are bullish around 5/15min, look to place long orders based on Price Action, MA Cross, Indicator Action or combination.

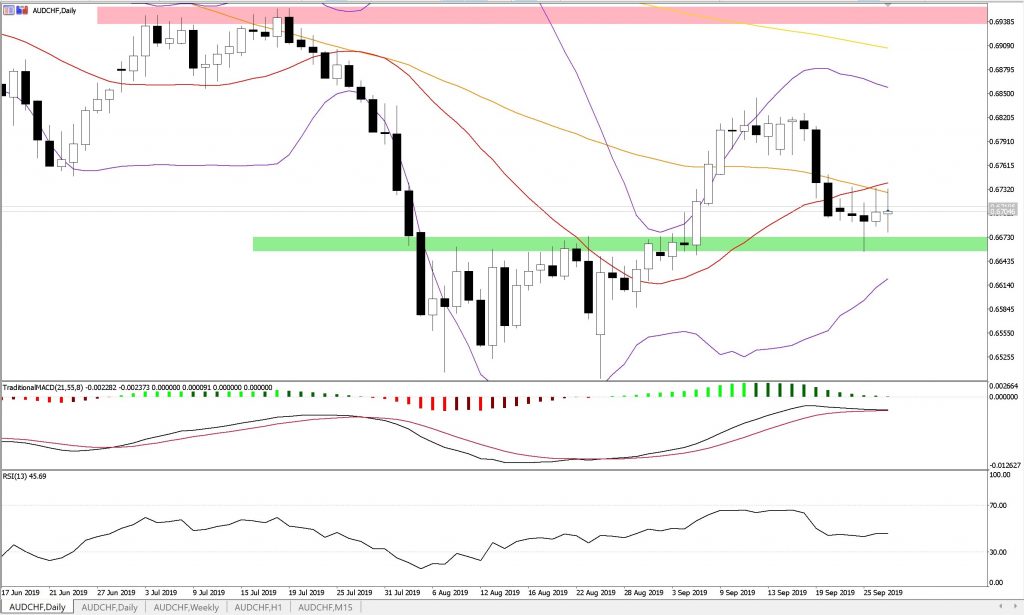

GBPUSD – Bearish

If price breaks below support area, look for shorts

W1: Strong three candle reversal pattern at resistance zone which is also 38.2% retracement area

W1: Price below moving averages in down trending order (21 < 55 < 144) which is bearish

W1: Price rejected by 21 MA

D1: Price stopped at resistance area (also 23.6 Fibonacci level), expect small bounce before continuing downward

H4: Price broken below 144 MA and unable to reach back above after previous attempt.

H4: MACD confirming downward move

H1: Price below moving averages in down trending order (21 < 55 < 144) which is bearish

H1: Price breaking downwards and retracing to Fibonacci levels on each descent

If the above holds true and there are bullish around 5/15min, look to place short orders based on Price Action, MA Cross, Indicator Action or combination.

You must be logged in to post a comment.