All weekly Forex analysis are high-level and sets the week ahead. However markets change due to news and events so this may evolve. I do Monthly, weekly and daily scans every week for context. Higher TF help to guide the lower so as to give an indication or hint as to the direction of the market and potential entry points. I try to focus on price action and use indicators secondarily for probability of reversals or change in market sentiment.

Charts shown do not necessarily mean that I will be entering them, however I will observe for potential opportunities as they’re either a setup being played or about to be played.

20 SMA = RED

50 SMA = ORANGE

200 SMA = YELLOW

Bollinger Bands = PURPLE

MACD (prefer to use in non trending market)

RSI (prefer to use in non-trending market)

NEWS

Wed Jan 23

Tentative JPY BOJ Outlook Report

Tentative JPY Monetary Policy Statement

Tentative BOJ Press Conference

Thu Jan 24

0:30 AUD Employment Change

0:30 AUD Unemployment Rate

NZDUSD – Sell

DY: Price still indicating downward move

H4: Price reacting bearishly to 50MA as resistance level

H4: 20 MA crossing under 50 and 200MA

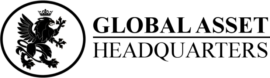

AUDNZD – Buy

WK: Bullish continuation,

WK: Price breaks above ascending trend-line since AUG 2016

DY: 20MA as support after breaking early JAN (old resistance, new support)

H4: Price in range expecting upward break once 20MA reaches

H4: Price above 20,50,200MA order, view as upward trend

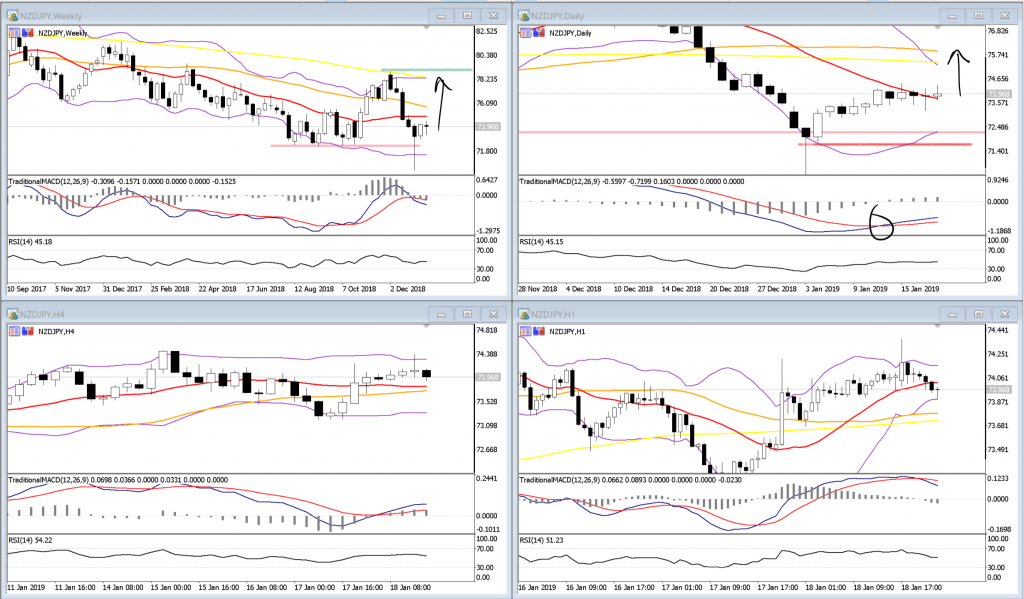

NZDJPY – Buy

WK: Bullish engulfing pattern, followed by doji signifying some indecision however does not appear at any support or resistance zones

DY: MACD bullish cross over

AUDJPY – Sell

WK: Price didn’t break above the marked resistance area.

WK: rice below 20,50,200MA order, view as down trend

DY: Doji at short term resistance area

H4: Cloud cover pattern, Doji, shooting star,

H4: Price at top of BB

H1: Price below 20MA signifying potential to move down

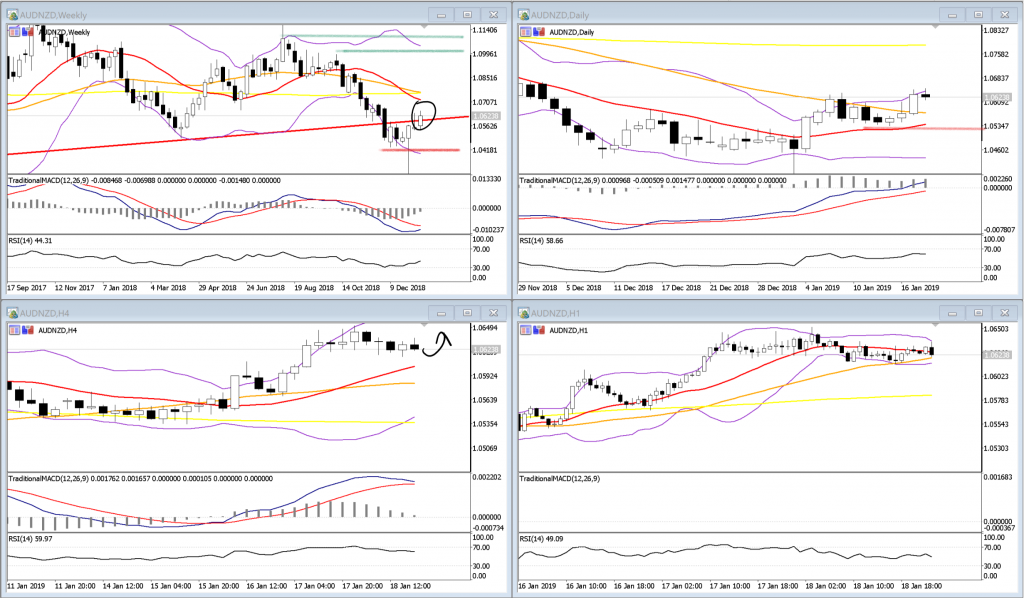

USDJPY – Buy

WK: Doji, Bullish engulfing, Morning star

WK: Price at bottom of BB

DY: Price breaks short term resistance

DY: Price moves above 20MA

H1: Price reacting to 20MA as support

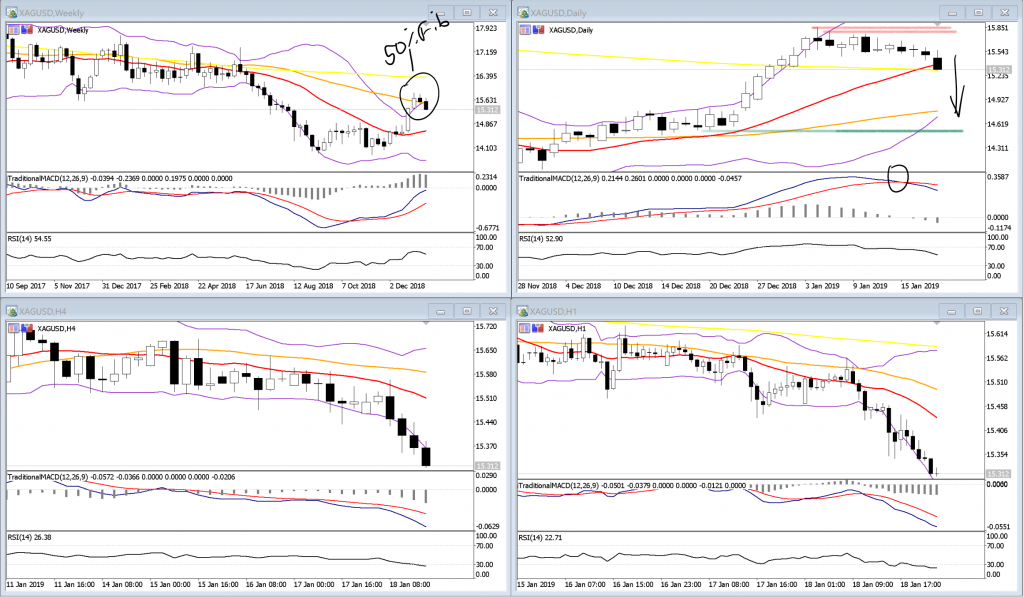

XAGUSD – Sell

WK: Dark cloud pattern

WK: Pattern at top of BB signifying over bought

WK: Price at 50% Fibonacci retracement area

DY: MACD cross under

DY: Price closed under 20MA

You must be logged in to post a comment.